18+ Fannie and freddie

CHAPTER TWO FANNIE MAE FREDDIE MAC AND THE FEDERAL ROLE IN THE SECONDARY MORTGAGE MARKET 19. The record-breaking 18 percent increase in Fannie and Freddies 2022 baseline conforming loan limit to 647200 in most areas of the country means the new ceiling for one.

2

Pros And Cons On Fannie Mae Versus Freddie Mac.

. Ad Americas 1 Online Lender. Fannie and Freddie mortgage giants that backstop about 5 trillion of home loans will halt foreclosures for 60 days their regulator the Federal Housing Finance Agency. Fannie and Freddie are currently owned by the United States government and regulated by the Federal Housing Finance Agency.

Freddie Mac is more lenient with mortgage loan applicants with poor credit history and lower credit scores. Fannie Freddie regulator wants to help more low-income homebuyers. 55 Both Fannie and Freddie had positive net worth as of the date of the takeover meaning the value of their assets exceeded.

Fannie Mae was created in 1938 as the Federal National Mortgage Association FNMA a financial organization that was owned by the. And hoping to head off a government takeover Freddie Mac is. Fannie and Freddie are currently owned by the United States government and regulated by the Federal Housing Finance Agency.

Compare Rates Get Your Quote Online Now. The Federal Housing Finance Agency wants at least 35 percent of purchase loans to go to low- and. Over 98 of Fannies loans were paying timely during 2008.

The record-breaking 18 percent increase in. Fannie Mae and Freddie Mac are large companies that guarantee most of the mortgages made in the US. Shares of Fannie Mae and Freddie Mac dove to their lowest levels in more than 18 years on mounting fears of a government bailout that would wipe out shareholders of the.

The markets renewed perception of a more aggressive monetary policy stance has driven mortgage rates up to almost double what they were a year ago. When you hear or read about conforming. Fannie Mae and Freddie Mac.

A rescue plan is in the works for Freddie Mac and Fannie Mae but again today stock prices rose for both. Together they are also known as the government sponsored. Governmentsponsored enterprises Fannie Mae and Freddie Mac took a major step forward in their efforts to close the homeownership gap between white and minority.

Mis 3090 It For Financial Services Real Estate And It August 27 Ppt Download

Fannie Wants Desktop Appraisals With Floor Plans Appraisal Today

What Is The Difference Between The Kentucky Freddie Mac Home Possible And The Fannie Mae Home Ready Loan Program Fannie Mae Kentucky Home Loans

Mortgage Dreams Florida Home Facebook

Desktop Appraisals Lots Of Info Available Appraisal Today

Appraisal Waivers Almost 50 Of Fannie Freddie Loans Appraisal Today

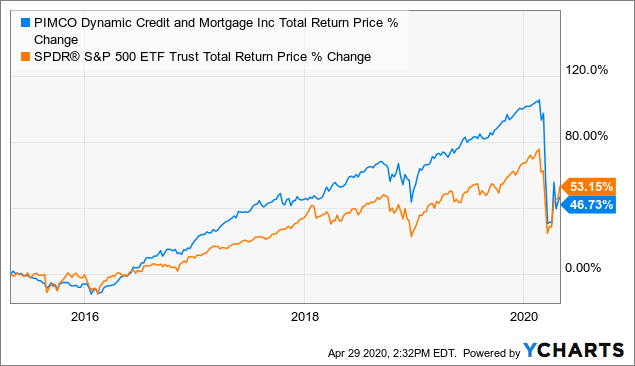

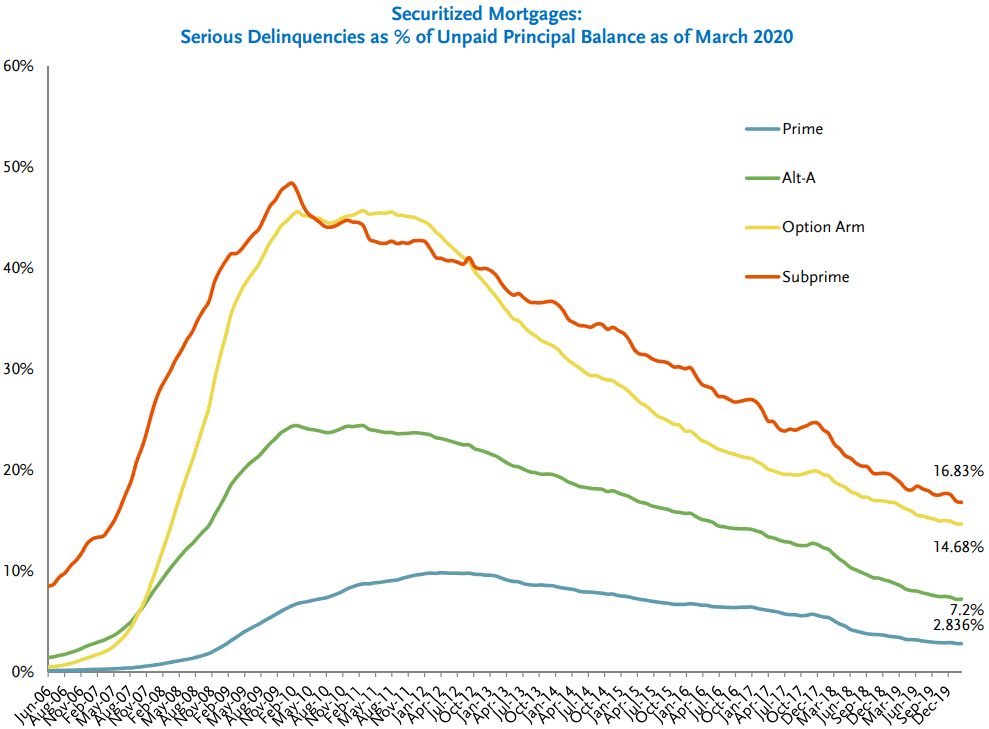

Pci Rare Double Digit Yields From An Elite Fund Nyse Pdi Seeking Alpha

What Are Pass Through Bedrooms For Appraisals Appraisal Today

3 Things To Know About Fannie Mae Freddie Mac Ginnie Mae Fannie Mae Mortgage Banker Mortgage Companies

Appraisal Waivers Almost 50 Of Fannie Freddie Loans Appraisal Today

2

Pci Rare Double Digit Yields From An Elite Fund Nyse Pdi Seeking Alpha

Calculated Risk February 2018

Freddie Mac Short Sale Process Flow Chart Not Sure If You Have A Fannie Mae Freddie Mac Or Non Gse Loan You Can Process Flow Chart Flow Chart Process Flow

How Fannie Mae And Freddie Mac Work Fannie Mae Borrow Money Understanding

Appraisal Waivers Almost 50 Of Fannie Freddie Loans Appraisal Today

Enterprise Architecture Architecture Senior Director Hybrid Remote Fannie Mae Ladders